Cynthia Eaton

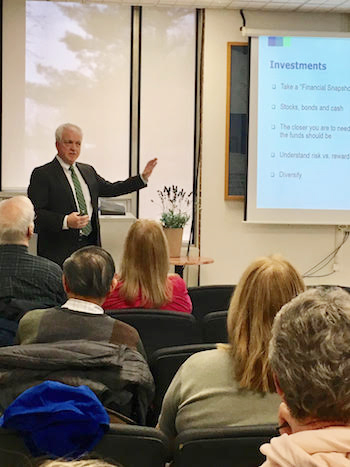

After a reference to the Supreme Court Janus case and the FA asking members to sign membership pledge cards, Gerry McGahran, director of financial planning for Stacey Braun Associates, didn't mince words: McGahran was presenting the FA's annual retirement and financial planning workshops on Friday, April 13, in the Babylon Student Center. Of course, there are plenty of other reasons to say "I'm sticking with the union"—a belief in social justice, fairness and equity, solidarity, using our political voice to fight for our profession, etc.—but McGahran rightly notes that the benefits of membership far outweigh the cost of our dues. From Hire to Retire McGahran's "From Hire to Retire" financial planning workshop addressed issues of cash management, insurance, investing, retirement, education planning, estate planning and financial assistance and resources. He started with the basics—understanding how to calculate your assets and liabilities to determine your net worth—then shifted right into setting goals, budgeting, understanding credit and managing debt. After reviewing some basic types of insurance (life, disability, long-term care), McGahran dove into one of his specialties, understanding and maximizing your personal investments. He discussed cash, bonds and stocks; allocation of assets; and diversification and risk tolerance. This is easily the most popular section of his workshop each year, as McGahran patiently responds to our members' individual questions and requests for advice. This workshop wrapped up with points of advice about any education planning and estate planning members might be dealing with. Retirement Planning The time to start planning for retirement is not when you're looking to retire in the next year or so. The sooner you start, the better. Many of our members have benefitted over the years from McGahran's retirement planning assistance during their individual meetings. But this workshop offers an excellent overview and gives members sufficient information to get started with their planning. McGahran's retirement workshop is divided into the following sections:

The most common roadblocks to a financially secure retirement, McGahran noted, are not setting goals, lack of understanding, debt, poor investment choices, inflation, taxation and proscrastination. Don't let these roadblocks negatively impact your happiness and well being after retirement! Stick with the union*, attend our workshops next year and make the most of your union membership. * Where it asks you to enter our local name, simply type our NYSUT local affiliate number: 39-045. |